Minnesota Department of Human Services

Instruction Manual

Annual Statistical and Cost Report of Nursing Facilities

For the Reporting Year Ending September 30, 2017

This manual has been prepared to

assist Providers participating in the Minnesota Medical Assistance Program in

completing the annual statistical and cost report of nursing facilities.The cost report, supplemental schedules and

other data required to be submitted with this cost report provides the cost

basis for the determination of rates to be paid to nursing facilities.

GENERAL INSTRUCTIONS

The deadline for submission of the Annual Statistical and Cost Report is 11:59 pm on February 1, 2018.

The Cost Report must be filed electronically via the Provider Portal. Some of the reporting fields will be pre-filled based on information from the previous year’s Cost Report or other data sources.This pre-filled information should be reviewed for accuracy and updated, if necessary.

The online electronic Cost Report contains 7 sections: General Information, Beds, Resident Days, Employee Data, Costs/Expenses, Assets/Debts/Leases, and Scholarship Expenses. All seven sections must be completed prior to submission. Moving between these sections can be done by using your mouse to click on the titles listed on the left side of the screen.

Once the Cost Report is complete, click on "Run the Edit Report." The edit report will contain warning or error messages that must be corrected in order for the system to accept the Cost Report.

Warnings will be messages indicating that the data appears to be incorrect; the warning message will ask that the data be reviewed for accuracy. Additional messages will identify that a required field is missing an explanation or data input or there is inconsistent data that does not match throughout the report. These errors must be corrected in order for the system to accept the Cost Report.

You can exit the Cost Report and reenter the report via the Provider Portal at any time. Any data entered during a previous session will be saved if you have chosen to save changes. Once you have corrected all errors and clicked the submit button, you will not be able to retrieve the Cost Report. Print out a copy of the completed Cost Report for your records before the report is submitted. Please contact the Department if you have submitted an incorrect report. Contact information is provided below.

Policy Questions

Any policy questions regarding the completion of the report which are not addressed in this manual should be directed to any of the following Department staff:

| Shelly Jacobs | michelle.jacobs@state.mn.us | 651-431-2561 |

| Heather Kamps | heather.kamps@state.mn.us | 651-431-2604 |

| Jane Gottwald | jane.gottwald@state.mn.us | 651-431-4348 |

| Kim Brenne | kimberly.brenne@state.mn.us | 651-431-4339 |

Technical Assistance

If you need technical assistance navigating the web-based application (Provider Portal), please contact:

| Gary C. Johnson | gary.c.johnson@state.mn.us | 651-431-2279 |

Submitting Multiple Cost Reports

If you are responsible for submitting multiple Cost Reports, there is an upload feature available which will allow you to upload a comma delimited text file which will pre-fill most of the line items in the Cost Report. After uploading, you will still need to review the Cost Report in the Provider Portal, complete the remaining required fields such as entering explanations for adjustments, and run the edit report. The edit report must be reviewed and any corrections entered before submitting the completed Cost Reports.

Incomplete, Inaccurate or Late Cost Reports

The Department may reject a Cost Report filed by a nursing facility if it is determined that the report has been filed in a form that is incomplete or inaccurate and the information is insufficient to establish accurate payment rates. If a Cost Report is rejected or is not submitted in a timely manner, the Department will reduce payments to a nursing facility to 85 percent of amounts due until the information is complete and accurately filed. The reinstatement of withheld payments will be retroactive for no more than 90 days.

Written notice of a potential payment reduction will be given to a nursing facility that does not file the annual Cost Report in a timely manner or in the event the submitted Cost Report is rejected by the Department for incomplete or inaccurate information.The written notice will allow the nursing facility the opportunity to correct the Cost Report and submit the report to the Department within 10 days before the payment reduction is implemented.

Administrator’s Certification

This is a password protected site. The administrator has been provided a unique user name and password. The password can be changed by the administrator after the initial log in. The facility administrator is responsible for security of the password. If the administrator provides the password to a staff person or other outside cost report preparer, they are delegating the authority to those individuals to certify that the Cost Report submitted is a true and complete statement prepared from the books and records of the nursing facility in accordance with applicable instructions.

Reporting Requirements

All data in the Cost Report must be

based on the reporting period ending September 30, 2017.

Facilities submitting a Medicaid nursing facility Cost Report must

remove all costs associated with non-nursing facility operations using the

adjustments column on the Cost Report.

· “Nursing Facility Related Costs” column (Column 3) of the costs/expenses section of the report must contain only nursing facility related costs.

· Costs for items and services that are separately reimbursable by either other third party payors the resident(s) or resident responsible party, are to be removed from the “Balance per Books” column (Column 1) using the “Adjustments” column (Column 2). This includes costs incurred by providers in responding to a natural disaster as well as Ventilator-dependent Private Pay and MA recipients.

· If your organization has non-certified boarding care or other beds, you must remove the costs associated with these beds in the “Adjustments” column.

Financial Reporting Requirements

Facilities are required to submit additional

information annually with the Cost Report in addition to the online electronic

cost report form:

·

Supplemental Schedules:

Templates for Supplemental Schedules were created in Excel by the Department and are

available on the DHS Nursing Facility (NF) Provider Portal website.Alternative formats may be used to meet this

requirement. However, any format used

must have the same content as that shown on the Department’s templates.

·

Balance sheet and income statement

corresponding to the reporting year.

· Working trial balance, including a reconciliation schedule between the working trial balance and the cost report for each nursing facility. The reconciliation schedule should show how the “Nursing Facility Related Costs” Column (Column 3) of the cost report lines were calculated. If not, provide a mapping/grouping of expenses schedule.

The additional information and documentation must be

submitted to the Department by 11:59 pm on February 1, 2018:

· Email at DHS.NFRP.CostReport@state.mn.us , or,

· U. S. Mail to the following address:

Department of Human Services

Nursing Facility Rates & Policy

PO Box 64973

St. Paul, MN 55164-0973

Record Retention Requirements

1.

Facilities must maintain the required census

records and financial information in a manner sufficient to provide for a

proper audit or review. For any cost

being claimed on the Cost Report, sufficient data must be available as of the

audit date to fully support the report item.

2.

Accounting or financial information regarding

related organizations must be readily available to substantiate costs.Home office cost reporting and cost

allocation must comply with applicable sections in this manual and the Provider

Reimbursement Manual paragraphs 2150 and 2153.

3.

Each provider shall maintain, for a period of

not less than five years following the date of submission of the Cost Report to

the Department, accurate financial and statistical records of the period

covered by such Cost Report in sufficient detail to substantiate the cost data

reported. Each provider shall make such

records available upon reasonable demand to representatives of the Department.

Hospital-attached Facilities

Hospital-attached facilities are required to complete only the "Hospital-attached Expense Not Directly Identified" lines (the line numbers that end in "95") for all cost categories except as noted below. If the facility tracks direct expenses for some departments but not all, line item detail may be reported for those departments where expenses are directly identified. The amounts for the following lines (or other lines where expenses are directly identified) should be subtracted from the "Hospital-attached Expense Not Directly Identified" line in their corresponding category and reported on these individual lines:

· Line 7011 - Surcharge Expense

· Line 7012 - Real Estate Taxes

· Line 7014 - Special Assessments

· Line 7015 - MDH Nursing Facility License

· Line 7017 – Scholarship Costs

· Line 7018 – PERA Contributions

· Line 7020 – Resident & Family Advisory Council Costs

· Line 9021 – Health Savings Account (HSA)

· Line 9022 – Group Medical Insurance

· Lines 6111 through 6290 – Care Related Costs

Hospital-attached facilities are allowed to use the same step-down statistics as their Medicare fiscal year end. However, report year end costs at 9/30/17 are to be used for the step-down.

Entering Adjustments on the Cost Report

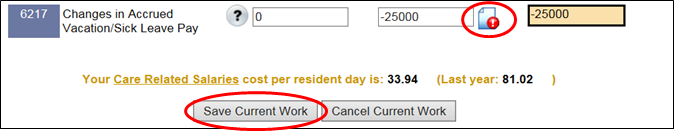

Step 1:To make an adjustment to the “Balance per Books” column of the Cost Report, the adjustment amount should be entered as either a positive or negative number in the “Adjustments” column on the electronic report form. To save the entered adjustment, click “Save Current Work” and a red icon will appear next to each entered adjustment as shown below:

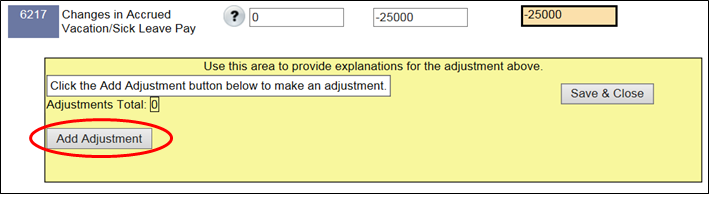

Step 2: The red icon is a warning message to indicate that an explanation is required to be entered for the adjustment made in the “Adjustments” column. "Explanations of Adjustments Made to the Report" are to be entered if adjustments are made to any item on the Cost Report. Click the red icon which will open the adjustments window:

Step 3: To enter an explanation, click “Add Adjustment and the following box will appear:

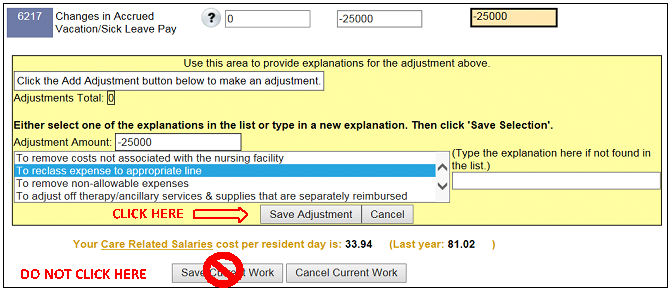

Step 4: Enter the amount of the adjustment in the box provided and select the adjustment explanation from the drop down menu OR enter your own adjustment explanation in the box provided. NOTE: The system cannot accept more than one explanation; make sure to select either an explanation from the drop down menu OR enter your own explanation. If both the drop down menu explanation and your own explanation are selected, the system may error out.

IMPORTANT: To save the adjustment amount and explanation entered in the adjustments window, you must click the “Save Adjustment” button contained in the adjustments window. DO NOT CLICK “Save Current Work” below the adjustments window; the system may not properly save the adjustments entered in the adjustments window.

Multiple adjustment amounts and explanations can be entered for each Cost Report line in the adjustments window.After you have saved the first adjustment and explanation by clicking the “Save Adjustment” button, if you would like to add additional adjustment amounts and explanations in the same Cost Report line, follow Steps 3-4 again as outlined above.

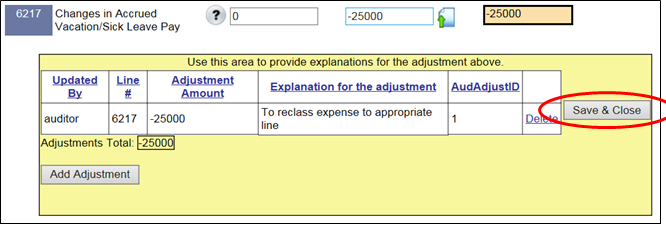

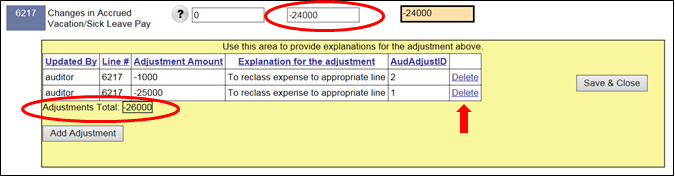

Step 5: Once you are finished entering all of the adjustment amounts and explanations on the Cost Report line, you must complete the entry by clicking the “Save and Close” button contained in the adjustments window:

Failure to complete the entry by clicking the “Save and Close” button contained in the adjustments window may cause the system not to save the adjustments you have entered.

IMPORTANT: The system will automatically total the adjustment amounts entered in the adjustments window and update the total column – the “Adjustments” column (Column 2). You should ensure Column 2 is the amount you are adjusting from the “Balance per Books” column. If Column 2 is incorrect, click on the icon (it may be red or green) and review the adjustment amounts entered in the adjustments window:

If the adjustment amounts entered in the adjustments window do not equal Column 2, the system should generate a warning icon.To fix this error, delete the incorrect adjustment entry by clicking “Delete” next to the entry.Enter a new adjustment entry to correct the error as previously instructed in Steps 3-5.

NOTE: If you have numerous adjustments and/or explanations for one Cost Report line, you may submit a separate explanation of adjustments worksheet in lieu of entering the explanations in the electronic form as long as the separate worksheet identifies the Cost Report line, adjustment amounts, and a detailed explanation for each adjustment which will be sufficient for an auditor to review what was adjusted on the Cost Report.

Please review each of the data fields carefully and complete or change them as needed. Click on the nearest “Save Current Work” button to update the general information page.

General and Ownership Information

Facility Licensed Name: Record the licensed name as it appears on the license granted by the Department of Health. If the licensed name is longer than 75 characters, abbreviate as necessary.

Ownership Code (Type): An organization is considered to have control if it has the power, directly or indirectly, to direct or to influence significantly the actions or policies of another organization or institution.

Physical Plant Owner: The physical plant owner field must have a valid selection. Use the drop-down menu to select the type of entity that owned the physical building of the nursing facility on the last day of this cost reporting period. This may or may not be different than the ownership code. Note that Real Estate Investment Trust (REIT) is included in the drop-down menu.

Admissions during report year: Record the total number of NF and NFII resident admissions (Medicaid and non-Medicaid).

Legal Business Name as reported to the Internal Revenue Service (IRS): Record the name of the parent or controlling organization as it appears in the records of the IRS. If the name is longer than 40 characters, abbreviate as necessary.

Controlling Organization: Record the name of the parent or controlling organization as it appears in the records of the Minnesota Secretary of State offices or in the Secretary of State offices of the state where the parent/controlling organization was formed. If the name is longer than 40 characters, abbreviate as necessary. An organization is considered to have control if it has the power, directly or indirectly, to influence or direct significantly the actions or policies of another organization or institution.

Number of facilities: The Minnesota facilities line must be at least "1" (for this facility).

Other Minnesota facilities:

Record the name and provider ID of all Minnesota related nursing facilities.Related facilities include all affiliate

nursing facilities under common ownership or control.

General

The Licensed & Certified Beds section is for the recording of bed status and the types of changes to bed status during the reporting year.

0090

The number of licensed beds in active service on the first day of the reporting year has been pre-filled based on the information reported at the end of the previous report year. Active service means beds that are being used by a resident or can be filled by a resident at any time.

0095

The number of licensed beds in layaway status on the first day of the reporting year has been pre-filled based on the information reported at the end of the previous cost report year.

Change in number of beds

This section is to record changes in bed status during the reporting year. Any bed changes that occurred after 9/30/15 and before 10/1/16 have been presented for you to review and edit if necessary. Record changes in bed status by type of change, the date of change, and the number of beds changed. Record all bed changes as positive values.The change types are:

· Placed on layaway (beds removed from active service and the layaway was recognized by MDH)

· Removed from layaway (beds removed from layaway and placed back into active service per MDH approval)

· Permanently delicensed (beds de-licensed / closed)

· Beds acquired from a different facility (relocation of beds to this facility; this requires MDH approval)

· Relocated to a different facility (bed(s) removed from this facility and transferred to a different facility; this requires MDH approval)

If beds previously placed on layaway were delicensed during this reporting period, first record the removal of beds from layaway and then record the permanently delicensed beds.

· Single-bed rooms are those where a bed does not share access to the corridor with another bed. A private room is a single-bed room that has a toilet area that it does not share with another bed. Two single- bed rooms that have a toilet area between them and each bed has a door to the toilet area are not private rooms; they are to be reported as single-bed rooms.

· Split-double rooms are those where two beds share access to the corridor, but there is a fixed, floor to ceiling, partition that physically splits the room in two.

· Double-bed rooms are those where two beds share access to the corridor and there is no fixed partition separating the beds.

· Three- and four-bed rooms are those where the given number of beds shares access to the corridor.

When completing this table, enter the number of beds in each of these configurations as of the last day of the reporting period and not the number of rooms. Do not report beds that have been put on layaway.

Bed configurations from the prior report year are displayed for your review. If the bed configurations reported on your previous cost report contains an error, please contact the Department.

0273

Record the number of Medicare-certified skilled beds at the end of the reporting year.

Single/Private-bed room Differentials

Report the amount(s) currently charged for a single-bed room (a.k.a., the private room differential).

5001 - 5050

Total Nursing Facility resident days must be broken down into the 50 categories under the MINNESOTA Case Mix Classification RUGS-IV System for dates of service October 1, 2016 through September 30, 2017. Record the RUG determination made by the Department of Health to classify each of the residents. The total days must be broken down to the proper column (Private Pay, Medicaid, Medicare, Other). List nursing home residents only (NF Rule 80 and NF non-Rule 80) on these lines. Do NOT include resident days provided in nursing home beds that are not certified as NF in the Medicaid program. Do not report negative resident days in any field.

Examples of "Other" days include Veterans Administration, Railroad, HMO, LTC Insurance, and Managed Care Health Plans (i.e., MSHO, MSC+). Hospice days should be reported by whichever payor was reimbursing the nursing home for room and board, typically either Private Pay or "Other." For example, if a hospice agency is paying the nursing home for room and board, the days should be reported as "Other" days regardless of who is paying the hospice agency. Unpaid bedhold days are not to be included in the report.

NOTE: If the facility had resident days at a penalty classification, these days are to be reported as resident days at the RUG class established immediately after the penalty period, if available, and otherwise, at the RUG class in effect just prior to when the penalty period began. See MN Statutes, Section 256R.02, Subd. 50.

Board and Care (NF II) Resident Days

5051 - 5100

NF II resident days are to be listed on these lines. Do NOT include resident days provided in Board and Care licensed beds that are not certified as NFII.

NOTE: If the facility had resident days at a penalty classification, these days are to be reported as resident days at the RUG class established immediately after the penalty period, if available, and otherwise, at the RUG class in effect just prior to when the penalty period began.

Section 4: Employee Data

Care Related Staff Retention

1619 - 1638

In column 1, record the number of employees on the first day of the report year (October 1). Include a part-time employee as one employee, not as a fraction of a full-time employee. Employees shared between two facilities under the same ownership or management should be counted as an employee for both of the facilities.

Van drivers/Transportation staff is to be included as a care related worker if they are nursing, social service or activities staff and should be reported in those categories. A full time van driver or an employee of a support service category such as maintenance should not be included in the care related employee data.

Seasonal employees should be counted as active employees if they are working at the end of the reporting period or it is anticipated they will be working in the next 10 months or 300 days.

On-call employees: On-call employees are not to be included in the employee data. An on-call employee provides temporary services for the nursing facility and the nursing facility includes the employee on their payroll system. An on-call employee is not regularly scheduled at any time during the reporting period. A regularly scheduled part or full-time employee that changed to on-call status during this reporting period is to be counted as a termination.

Probationary employees: Employees are considered active employees on their hire date. Employees still in their probationary period at the beginning of the report year are included in the number of employees reported at the beginning of the report year.

1619 - 1638

In column 2, record the number of employees who were employed for the entire reporting year for each job category. In other words, of those listed in column 1, report how many were still employed on the last day of this reporting year. In column 2, do not include employees who transferred from listed categories to job categories other than those listed. Do include employees that transfer within these job categories. An employee transferring to another job category listed and still employed at the end of the report year, should be counted in the category where they started the report year.

1619

Nursing administration includes licensed nursing staff responsible for management of the nursing department or primarily responsible for record keeping. Examples of nursing administration staff include: DON, ADON, MDS coordinator, Medicare nurse, in-service educator, infection control nurses and quality coordinators. Staff performing administrative duties that are not licensed as a nurse, such as a unit coordinator, scheduler or medical records staff are not to be counted as care related nursing administration staff.

1637

Activities staff includes: the supervisor and other activities workers including volunteer coordinators and recreation aides.

1638

Other Care Related Staff means any other staff providing care related services to residents including feeding assistants and religious personnel. Room service attendants are not considered care related staff. Dietary aides who are not trained and certified as feeding assistants should not be included. Volunteer coordinators should be reported on line 1637. Do not include licensed therapists or assistant therapists working under a licensed therapist’s supervision performing billable therapy services. Generally, for retention reporting purposes, employees should be classified according to their certification or licensure category regardless of the job title. Universal workers who are C.N.A.s should be reported on the C.N.A. line.

Care Related Staff Retention Rate is determined by the number of care related employees on the first day of the report year (October 1) that were still employed on the last day of the report year (September 30) divided by the number of care related employees on the first day of the report year (October 1).

Productive Hours

0301 - 0325

Generally, all hours worked by employees classified as care related workers are to be reported as productive hours, including licensed nursing administrative staff. This includes on-the-job training for both the trainee and the trainer.

Employees performing both care related and support services must have their hours and wages allocated between cost categories. The allocation methodology must be documented by the facility and be available upon request by the Department. Care related hours worked by Universal workers who are C.N.A.s should be allocated to the C.N.A. line. The proportion of hours related to non-care related duties such as housekeeping or dietary, are not to be included as productive care related hours. Periodic time studies, in lieu of ongoing time reports, may be used to allocate direct salary and wage costs between applicable cost categories. A sample Universal Worker Time Study Template is on the Facility Home page of the NF Provider Portal.

The time studies must meet the following criteria:

· A minimally acceptable time study must encompass at least one full week per six month period of the reporting period.

· The weeks selected should vary among the two required weeks, e.g., one the first week of the month, one the third week of the month

· The time study should not occur in two consecutive months.

· The time study must be contemporaneous with the costs to be allocated. Thus, a time study conducted in the current cost reporting year may not be used to allocate the costs of prior or subsequent cost reporting years.

· The time study must be facility specific. Thus, chain organizations may not use a time study from one facility to allocate the costs of another facility or a time study of a sample group of facilities to allocate the costs of all facilities within the chain.

· The time study must be individual specific. Thus one employee’s time study cannot be used to allocate the costs of all blended workers performing the same/similar duties.

The following exceptions are not to be reported as productive hours:

o Medical records personnel time must be excluded from “Productive Hours.”

o Non-licensed nursing administrative staff such as unit coordinators and schedulers must be excluded from productive hours.

o Vacation, holiday, sick leave, classroom training and meal breaks should be excluded in this computation, but coffee breaks should be included.

o Volunteer hours.

0312 - 0315

Report external staffing hours only, Supplemental Nursing Services Agency (SNSA). The hours for internal pool staff that are on the facility's payroll are NOT to be reported here.

Report interim nursing administration support hours from consulting firm staff here. SNSA hours are NOT to be reported here.

Record productive hours for Other Care Related Staff on this line. Other Care Related Staff includes any nursing employees who do not fit into Nursing Administration, RN, LPN, C.N.A. or TMA categories. Do not include medical records personnel. Include any other staff providing care related services to residents such as feeding assistants and religious personnel. Dietary aides are not to be included. Do not include licensed therapists or their assistants performing separately billable services including Medicare Part A and B or other third party payor.

Pool Usage Calculation: The Temporary Staff Pool Usage Percentage is calculated by using the total Nursing Pool RN, LPN, C.N.A., TMA hours divided by the total RN, LPN, C.N.A., TMA productive hours and total Nursing Pool RN, LPN, C.N.A., and TMA hours.

Care Related Staff Hours per Resident Day: The following list describes the steps taken to determine the care related staff hours per resident day.

· Resident days include NF days and NFII days (Report lines 5001 to 5100).

· Both regular and pool productive hours are included (Report lines 0301 to 0320).

· Productive hours are converted into Hours per Resident Day figures: RN hours / resident days, LPN hours / resident days, etc.

The following job classifications are considered direct care staff for the purposes of assigning stars on the MN Nursing Home Report Card for the direct care staff hours per day measure. Hours per Resident Day are weighted for relative cost per staff type (statewide average salary ratios):

|

Staff Type |

Ratio |

|

DON/Nursing Administrator |

2.14 |

|

RN |

1.95 |

|

LPN |

1.50 |

|

C.N.A |

1.00 |

|

TMA |

1.11 |

|

Mental Health Worker |

1.25 |

|

Social Worker |

1.45 |

|

Activity Staff |

1.05 |

|

Other Care Related Staff |

1.41 |

· Sum of cost weighted hours =

(DON hrs paid * DON cost wt) + (RN hrs paid * RN cost wt) + (LPN hrs paid * LPN cost wt) + (C.N.A. hrs paid * C.N.A. cost wt) + (TMA hrs paid * TMA cost wt) + (MH hrs paid * MH cost wt) + (SW hrs paid * SW cost wt) + (ACT hrs paid * ACT cost wt) + (OTH hrs paid * OTH cost wt).

· Sum of cost-weighted hours is adjusted for facility average acuity: Adjusted Hrs paid = (Sum of cost weighted hours) / average acuity.

Compensated Hours

Record the hours paid by employee classifications. Paid vacation, sick, holiday hours, etc., should be included. Compensated hours should be equal to or greater than productive hours reported on lines 0301- 0320. Compensated hours must be allocated to care related hours according to the same methodology adopted for allocation of productive hours and salary expense for those employees performing both care related and support services.

In order to accurately compute average hourly rates, it is important that compensated hours for care related workers are classified in the same category that their associated salaries are reported. For example, if the salary for a Universal worker has been allocated between C.N.A. salaries and support services salary, the compensated hours for the C.N.A. on line 0380 should reflect the same proportion used to allocate the salary.

The reported salary cost per compensated hour calculation for Nursing Administration includes both lines 6111 and 6260.

Other Employee Information

0401 - 0414

Record the total number of employees by employment status as of the last day of this reporting period as either FT (full-time) or PT (part-time). The term “full-time employee” means, an employee who is employed on average at least 30 hours of service per week. Report the number of workers, not by FTEs. Exclude temporary workers, on-call staff, casual workers and contract workers.

Employee Health Insurance

0601

Indicate whether the nursing facility offered employee health insurance during the cost report period.

If the facility selects “Yes” on Line 0601, the following additional Cost Report lines must be completed:

0602

Enter the total number of employees who were enrolled in the facility’s health insurance plan as of the last day of the report period.

0603

This is a new line for the Cost Report ending 9/30/2017. If the facility offered health insurance at any time during the cost report period, indicate “Yes” if the health insurance plan was self-funded and/or the facility used a captive/related organization for all or part of its health insurance plan.

0604

This is a new line for the Cost Report ending 9/30/2017. Indicate “Yes” if at any time during the cost report period, the facility’s worker’s compensation insurance plan was self-funded and/or the facility used a captive/related organization for all or part of its worker’s compensation insurance plan.

Section 5: Costs and Expenses

Unless otherwise indicated, all cost data must be rounded to the nearest whole number (i.e., round .4 down, round .5 up).

Care Related, Support Services, G&A, Payroll Taxes, Payroll & Benefits, and

External Fixed Line(s)

General

"Balance per Books" must be recorded using the following principles:

· If the account has a debit balance, record as a positive amount

· If the account has a credit balance, record as a negative amount

· "Adjustments" may be positive or negative.

The "Balance per Books" column is to match the facility's income statement figures.

Cost Principles

Costs reported must use the Medicare Cost Reporting Principles. These principles adjust facility balance per books costs to actual cost and do not allow costs that are not directly related to the care of residents to be claimed for computation of the reimbursement rate.

For rate setting purposes, a cost must:

· Be ordinary, necessary, and related to resident care;

· Be what a prudent and cost conscious business person would pay for the specific good or services in the open market in an arm’s length transactions; and

· Be for good or services actually provided in the facility

Costs incurred due to management inefficiency, unnecessary care, agreements not to compete, or activities not commonly accepted in the nursing facility industry are not allowable.

Reasonable resident-related costs must be determined in accordance with the rate setting procedures set forth in this Instruction Manual and instructions issued by the Department, Minnesota Statutes, and principles of reimbursement for provider costs (Centers for Medicare and Medicaid Services Provider Reimbursement Manual).

The Adjustments column is to

be used to:

· Change Balance Per Books amounts to reflect actual expenses incurred such as eliminating profit on related-party transactions;

· Change Balance Per Books amounts to reduce costs to recognize charges, fees, grants, and gifts;

· Exclude items not recognized by Medicare such as the cost of telephones in resident rooms, contributions made, amounts donated to others, cost of political lobbying, personal expenses of owners or employees, costs related to fund raising events, salaries and associated costs of facility marketing, expenses related to changes of ownership of the facility, expenses related to providing special services, and penalties paid to governmental agencies. Items such as these should be separately reported in General and Administrative costs, line 8085, Other General & Administrative Expense, Medicare Non-Allowable in the balance per books column and removed in the adjustments column.

"Explanations of Adjustments Made to the Report" are to be entered if adjustments are made to any item on the Cost Report. Refer to Pages 3-6 of this Cost Report Instruction Manual for detailed steps of how to enter adjustments into the Nursing Facility Provider Portal.

Allowable Costs:

Costs

of the facility directly related to the care of residents which are ordinary

and necessary and determined to be acceptable costs during the Cost Report

period by the Department in accordance with the rate setting procedures set

forth in this Instruction Manual, Minnesota Statutes, and the Centers for

Medicare and Medicaid Services Provider Reimbursement Manual.

See

Exhibit 1: Cost Classification Table of Potential Allowable Costs on the last few pages

of this Instruction Manual for examples of common allowable costs.

Non-Allowable Costs:

Costs

of functions normally paid by charges to residents, employees, visitors, or others

such as the direct and indirect costs of operating a pharmacy, congregate

dining program, home delivered meals program, gift shop, coffee shop,

apartments or day care center are non-allowable and should be removed in the

adjustments column of the cost report.

See Exhibit 2: Cost

Classification Table of Potential Non-Allowable Costs on the last few pages of this

Instruction Manual for examples of common non-allowable costs.

"Applicable Credits" must be used to offset or reduce the expenses of the nursing facility to the extent that the cost to which the credits apply was claimed as a nursing facility cost.

· The related expenses must be reported on the appropriate expense line.

· Miscellaneous or other income must be shown as a credit to the related expense.

· Costs associated with expenses not related to resident care may be adjusted on the applicable expense line or total revenue associated with income not related to the nursing facility may be reported as an applicable credit.

"Bonuses" are to be recorded in applicable salary lines.

"Changes in Accrued Vacation/Sick Leave Pay" is the change in amount not utilized by the employee from year to year. It is computed by taking the accrued vacation pay and sick leave balances at the end of the reporting year and deducting the accrued vacation pay and sick leave balance at the end of the prior reporting year.

Changes in accrued pay

cannot be reported in salaries lines (line 6113, 6313, or 8013, for example).

Changes in accrued pay must be reported in the cost report lines that end with

"17".

SAMPLE ACCRUED VACATION PAY 9/30/XX

|

Name |

Vacation Hours

Balance 9/30/X1

|

Hourly Wage 10/1/X1

|

Vacation Accrual 9/30/X1

|

Vacation Hours Balance 9/30/X2

|

Hourly Wage 10/1/X2

|

Vacation Accrual 9/30/X2

|

Change In Accrued Vacation

|

|

A.Tarro |

47 |

7.49 |

352.03 |

35 |

7.74 |

270.9 |

(81.13) |

|

J.Nowon |

27 |

9.49 |

256.23 |

35 |

10.10 |

353.5 |

97.27 |

|

J.Cody |

60 |

8.50 |

510.00 |

42 |

9.00 |

378.00 |

(132.00) |

|

L.Folie |

34 |

6.13 |

208.42 |

35 |

6.33 |

221.55 |

13.13 |

|

T.Baron |

19 |

5.00 |

95.00 |

28 |

7.00 |

196.00 |

101.00 |

|

O.Dia |

5 |

12.53 |

62.65 |

12 |

13.25 |

159.00 |

96.35 |

|

Total |

|

|

|

|

|

|

94.62 |

SAMPLE ACCRUED SICK LEAVE PAY 9/30/XX

|

Name |

Sick Hours Balance 9/30/X1

|

Hourly Wage 10/1/X1

|

Sick Accrual 9/30/X1

|

Sick Hours Balance 9/30/X2

|

Hourly Wage 10/1/X2

|

Sick Accrual 9/30/X2

|

Change In Accrued Sick Leave

|

|

A.Tarro |

35 |

7.49 |

262.15 |

42 |

7.74 |

325.08 |

62.93 |

|

J.Nowon |

20 |

9.49 |

189.80 |

19 |

10.10 |

191.90 |

2.10 |

|

J.Cody |

83 |

8.50 |

705.50 |

57 |

9.00 |

513.00 |

(192.50) |

|

L.Folie |

45 |

6.13 |

275.85 |

45 |

6.33 |

284.85 |

9.00 |

|

T.Baron |

24 |

5.00 |

120.00 |

28 |

7.00 |

196.00 |

76.00 |

|

O.Dia |

8 |

12.53 |

100.24 |

10 |

13.25 |

132.50 |

32.26 |

|

Total |

|

|

|

|

|

|

(10.21) |

Personnel with multiple duties: When a person other than top management personnel has multiple duties, the person's salary cost must be allocated to the cost categories on the basis of time distribution records that show actual time spent, or an accurate estimate of time spent on various activities. In a nursing facility of 60 or fewer beds, part of the salary or salaries of top management personnel may be allocated to other cost categories to the extent justified in time distribution records which show the actual time spent, or an accurate estimate of time spent on various activities. An accurate estimate is derived from time studies completed by each employee with multiple duties.

· A nursing facility that chooses to estimate time spent must use a statistically valid method.

· Persons who serve in a dual capacity, including those who have only nominal top management responsibilities, shall directly identify their salaries to the appropriate cost categories.

· The salary of any person having more than nominal top management responsibilities must not be allocated.

Employee Union Information

For each salary line, click the “Yes” button if there is a union agreement in place effective on the last day of the reporting year. From the drop-down box, select the bargaining unit that covers the employees whose salaries are reported on that line. This cannot be done until the General Information section is completed.

For staff categories in the facility that are notrepresented by a collective bargaining unit, select “N/A” rather than “No”.

Select “No” for staff categories that are represented by a collective bargaining unit in this facility but for whom there was not a union agreement in place on the last day of this reporting period.

Care Related

6111

Nursing administration includes licensed nursing staff responsible for management of the nursing department or primarily responsible for record keeping. Examples of nursing administration staff include: DON, ADON, MDS coordinator, Medicare nurse, infection control nurses and quality coordinators. Staff in this category are primarily performing job duties where a nursing license is required. Interim nursing administration is not to be reported on this line.Interim nursing administration should be reported on Line 6176.

6116

Medical Records staff

that are primarily

responsible for record keeping or other administrative duties within the

nursing department are to be reported on this line. Examples include unit

coordinators, schedulers, medical records staff; duties for which a nursing

license is not required, etc.

Please

note the difference between line 6111 and line 6116 with regards to licensure.

6212

Activities staff salaries includes the wages of the supervisor and other activities workers such as volunteer coordinators and recreation aides.

6213

Other Care Related Staff includes staff providing care related services to residents who are not appropriately categorized on lines 6111 through 6212. Generally, employee salaries should be classified according to their certification or licensure category regardless of their job title. Examples of Other Care Related Staff include feeding assistants, religious personnel, and non-licensed and non-certified therapy aides. Other Care Related Staff does not include licensed therapists or therapy assistants providing services for billable therapies, including Medicare Part A and B.

6260

Record the wages of the employee in charge of conducting training in resident care topics for care related staff. Typically this will be the in- service director. Effective July 1, 2015, the employee scholarship program will provide reimbursement for nursing assistant training for newly hired and recently graduated nurse aides. If facility staff provides the nursing assistant training, the wages associated with the time spent conducting this training and competency evaluation, on and after July 1, 2015, must be classified as scholarship costs on line 7017 instead of line 6260.For additional instructions to report scholarship costs, refer to the section titled “NF Employee Scholarship Program” near the end of this instruction manual.

6261

Report non-wage related costs of training care related staff on this line. The costs of materials used for resident care training for direct care staff and training courses outside of the facility attended by direct care staff on resident care topics are to be reported on this line. Costs for nursing assistant training and testing must be reported on line 7017 (scholarship costs) instead of line 6261.

Provide a detailed schedule for the amount reported on this line. The detailed schedule should include the date, amount paid, vendor name, and the description/type of expenditure. Please see the Supplemental Schedule on the Provider Portal for additional information and a sample schedule.

6120

Nursing Supplies & Non-prescription drugs

includes supplies that are stocked at nursing stations or on the floor and

distributed or used individually, such as alcohol, applicators, cotton balls,

incontinence pads, disposable ice bags, dressings,

bandages, water pitchers, tongue depressors,

disposable gloves, enemas, enema equipment, soap, medication cups, diapers,

plastic waste bags, sanitary products, thermometers, hypodermic needles and

syringes, clinical reagents or similar diagnostic agents, and medically

necessary over the counter (OTC) drugs used on an occasional or as needed basis

(also known as “House Stock”). Over the counter drugs prescribed for a specific

resident for scheduled use should be

dispensed by the pharmacy in the manufacturer’s unopened package and submitted

separately to the resident’s pharmacy benefit plan (MHCP for Medicaid recipients)

for reimbursement.

Office

supplies are not to be reported on this line; these are considered to be an

administrative cost. However, pre-printed

physician telephone order forms that can only be used by licensed health care

staff should be reported on this line.

Provide a detailed schedule for the amount reported on this line. The detailed schedule should include the date, amount paid, vendor name, and the description/type of expenditure. Please see the Supplemental Schedule on the Provider Portal for additional information and a sample schedule.

6140

All prescription drugs paid for by the facility are to be recorded on this line. Prescription drugs are generally not considered an allowable cost because they are almost always billable to other payor sources. The Nursing Facility Related Costs column for this line of the cost report should typically be zero. Non-formulary drugs are not an allowable cost because there are other formulary alternatives, and, there is a prior-authorization process for getting these drugs covered through the prescription benefit.“Refill too soon” prescription drugs are generally non-allowable as they are often due to the drugs being lost in the facility.

6220

"Activity and Social Service Supplies" This line should include both supplies and services associated with the Activities and Social Services Department. Examples may include: cable television service in common areas, pet care and pet supplies, piano tuning service, art programs, entertainers/musician/dance/theatric performances at the facility and bus rental for resident outing activities. The reasonable costs of supplies for ADL-related activities such as manicures, hair styling and makeovers provided by facility staff that are not licensed beautician/barber may be considered part of the activities program, thus allowable.

Supplies/service haircuts, permanent waves, hair coloring, and relaxing performed by barbers and beauticians not employed by a facility are chargeable to the resident, thus not allowable and need to be removed in the Adjustment column of this line.

New for Cost Report 9/30/2017.Any beauty shop revenue collected should be recorded in the Adjustments column on 6220.

6176

"Health Care Consultants" includes utilization review, pharmacy, in- service, medical records, physician fees, nursing, infection control, medical director, other consultants and physical, occupational, speech and mental health consultants, and interim nursing administration.

Therapy consultants doing nurse's in-service training may be reported on this line. Consulting fees for therapy shall only be reported as nursing facility related costs to the extent that the nursing facility or the nursing facility's contractor cannot bill separately for these services.

6179

"Other Care Related Consultants" include social services, activities and religious consulting.Interpreter services provided by non-nursing facility staff are also to be reported on this line.

6180

Line 6180 should only contain the costs for the electronic charting systems/Electronic Medical Records (EMR)/Electronic Health Records (EHR) software costs which meet the following criteria:

· Not required to be capitalized

· Not already claimed under the Medicare/Medicaid EHR Incentive Program.

· Facilities should report the billing and resident trust component of software costs on Line 8080.

6240

All therapy salaries are reported on this line. Therapy salaries include licensed therapists and assistant therapists working under their supervision performing billable therapy, including Medicare Part A and B or any other third party payor. Therapists and therapy aides employed by the facility that are not providing billable services should also be reported here. Generally these services are separately billable thus not allowable on the cost report; costs associated with billable services should be removed in the adjustment column regardless of whether or not they were actually billed out.

6274

Payments to therapists who are not employees of the nursing facility are reported here. Facilities which bill separately for therapy services or whose contractor bills separately for therapy services shall remove the costs of those services in the "adjustments" column.

6280

Line 6280 is for all other care-related expenses not specified elsewhere on the cost report. Ancillary services (excluding therapy and pharmacy) are reported on this line with all costs adjusted off for those that are separately billable (e.g. Medicare Part A lab, x-ray and wound vac). Facilities with costs on line 6280 of the 2017 Cost Report form in the "Nursing Facility Related Costs" column are required to complete a detailed schedule of these costs. Please see the Supplemental Schedule on the Provider Portal for additional information and a sample schedule.

6290

Report only care-related applicable credits on line 6290 that cannot/should not be reported in the more specific cost category line of the Cost Report form. Miscellaneous or other income must be shown as a credit to the related expense.For example, purchase discounts or refunds for stock nursing supplies are applicable credits and must be reported on line 6120 to offset the related stock nursing supply costs.

For Beauty Shop revenue see the section for line 6220 of this instruction manual.

Facilities with costs on line 6290 of the 2017 Cost Report form in the "Nursing Facility Related Costs" column are required to complete a detailed schedule of these costs. Please see the Supplemental Schedule on the Provider Portal for additional information and a sample schedule.

Support Services

General

The salary expense of working in more than one department must be allocated between the applicable cost categories.

NOTE: If you are not a hospital-attached facility, all lines ending in "95" should be left blank, for example 6495.

Dietary

The section below for Dietary Costs and Number of Meals

served is a new section of the Cost Report beginning in RYE 9/30/2017.

This table is located in the Assets, Leases, and Debt section of the

Cost Report.

Enter the number of meals served and the associated income

for your facility as shown below into the Nursing Facility Provider Portal:

|

Line

|

MEALS SERVED

|

Number of Meals

|

Dietary Income

|

Total |

|

6341 |

Residents of this facility |

|

|

|

|

6342 |

Guest Meals |

|

|

|

|

6343 |

Meals on Wheels |

|

|

|

|

6344 |

Employees |

|

|

|

|

6345 |

Assisted Living |

|

|

|

|

6346 |

Hospital |

|

|

|

|

6347 |

Other |

|

|

|

|

6340 |

Total |

0 |

0 |

0 |

“Balance per Books” column for dietary costs should equal the total costs for all dietary operations, which may include costs for non-nursing facility operations (Assisted Living, Adult Day Care, Meals on Wheels, etc.)

If the provider has allocated costs to non-nursing

facility operations during the report year, these costs will need to be added

back in order to properly allocate total dietary costs based on total number of

meals served by the kitchen.

Dietary costs must be reported based on the total dietary costs and total number of meals served. Allocated dietary costs are required to be based on the meal counts; the applicable portion of dietary costs for non-resident meals served must be adjusted off the Cost Report in the Adjustments column of Lines 6313 to 6380.Any revenue reported on Line 6390 for non-resident meals should be removed.

A dietary allocation template has been included in Tab

A of the Supplemental Schedule.

Facilities may utilize this template in calculating the

dietary costs adjustments for non-resident meals.

6313

"Dietary salaries" includes the director, dietician, other dietary salaries, and bonuses.

6330

Raw food costs means the cost of food provided to nursing facility residents. This includes food thickener and special dietary supplements used for tube feeding or oral feeding, such as elemental high nitrogen diet.

Hospital-attached facilities must break this expense out from line 6395 or the Provider Portal system edits will prohibit the cost report from being submitted.

6380

Other dietary expenses include contracted food service (excluding food), supplies, and dietician consulting fees. Dietary training and travel is to be reported on line 8080.Office supplies used in the dietary department are not to be reported on this line; these are considered to be an administrative cost.

6390

Income from operations not related to resident care for which the facility does not track the number of meals served, such as vending machine or snack shop sales should be reported on this line.

All other revenues for operations not related to resident care including employee/guest meals, day care meals, meals on wheels, Assisted Living meals, etc. should be removed from this line and the applicable costs be adjusted off based on the number of meals served.

Laundry

and Linen Services

6413

Laundry salaries include the department head, other laundry and linen personnel, and bonuses.

6480

Other laundry and linen include supplies, linen and bedding, and purchased laundry services. Office supplies are not to be reported on this line; these are considered to be an administrative cost.

Housekeeping

Services

6513

Housekeeping salaries include housekeeping director, other housekeeping personnel, and bonuses.

6580

Other housekeeping includes housekeeping specific supplies and contracted housekeeping. Office supplies are not to be reported on this line; these are considered to be an administrative cost.

Plant

Operations & Maintenance

6613

Plant operations salaries include the maintenance chief, other maintenance personnel, and bonuses.

6630

Utilities include fuel, electricity, water, and sewer. Water provided by a vendor should be reported on Line 6680.

6680

Other maintenance expenses include supplies, repair parts, minor equipment, maintenance and service contracts, purchased services and medical waste and garbage removal.

Examples of item commonly reported on this line that should be reported elsewhere on the cost report: office supplies, licenses and permits.

All minor equipment which is not required to be capitalized must be reported on Line 6680. Examples of minor equipment are bedpans, kitchen utensils, cleaning utensils, reusable slings for patient lifts, and waste baskets. Minor equipment that must be capitalized per Generally Accepted Accounting Principles (GAAP) should be reported on line 1366, Assets Section.

General & Administrative

8013

Administrative salaries include the wages and bonuses for the administrator, assistant administrator, accounting, data processing, clerical, receptionist, and security staff.

Record the cost of professional liability insurance only. Automobile insurance is not to be reported on this line; it is to be reported on line 8080.

Record the cost of property insurance only.

The following table provides

classification of insurance costs.

CLASSIFICATION OF INSURANCE COSTS

|

Expense |

Cost Category |

Line Number |

|

Administrative Prof. Liability |

G & A |

8048 |

|

Automobile |

G & A |

8080 |

|

Board of Directors |

G & A |

8080 |

|

Building |

G & A |

8049 |

|

Building Contents |

G & A |

8049 |

|

Business Income |

G & A |

8080 |

|

Crime Coverage |

G & A |

8080 |

|

Dental (Group) |

Fringe Benefits |

9025 |

|

Disability |

Fringe Benefits |

9023 |

|

Extra Expense |

G & A |

8080 |

|

Flood |

G & A |

8049 |

|

General Liability |

G & A |

8080 |

|

Inland Marine |

G & A |

8049 |

|

Loss of Earnings |

G & A |

8080 |

|

Life (Group) |

Fringe Benefits |

9023 |

|

Medical (Group) |

External Fixed |

9022 |

|

MN Fire Surcharge |

G & A |

8049 |

|

Mortgage |

Interest Expense |

7031 |

|

Property of Others |

G & A |

8080 |

|

Umbrella |

G & A |

8080 |

|

Workers Comp |

Fringe Benefits |

9024 |

|

Other |

G & A |

8080 |

Record the costs of bad debt on this line. The amount reported in the "Balance per Books" column should tie to your reporting year trial balance. The amount reflected in the "Nursing Facility Related Costs" column most likely will NOT tie to your trial balance. The only bad debt that may be considered allowable bad debt on the MN Medicaid Cost Report is bad debt associated with Medicaid covered services for Medicaid recipients while they were covered by MN Medicaid. Any bad debt collected from Medicare during the report year should be entered as an adjustment in the adjustment column. Unpaid claims denied by Medicaid and Medicaid claims that have been written off are not allowable. Bad debt that is non-allowable per Medicare guidelines and/or has been disallowed by the Medicare Administrative Contractor (formerly Fiscal Intermediary) is not allowable. Do not include the costs of bad debt collection expense on this line; this should be reported on line 8080.

Provide a detailed schedule of the allowable bad debt amount being claimed in the Nursing Facility Related Costs column of line 8052. See the Supplemental Schedule on the Provider Portal for additional instructions and a sample schedule. This schedule is due by 11:59 pm on February 1, 2018. Incomplete, inaccurate, and illegible schedules will likely result in disallowances of costs.Please include an explanation of collection efforts for each resident costs included in the “Nursing Facility Related Costs” column.

Record central office costs and management fees directly related to the operation of the nursing facility on this line. The fiscal year central office allocation may be recorded if the fiscal year end is different than the reporting year end. Central office costs should be allocated to the nursing facility according to Medicare cost reporting principles.

Other general and administrative expenses include: fees, contracts, or purchases related to the business office functions; Administrator’s license fee, most other license fees (exceptions: EMR software Line 6180 and MDH license fees Line 7015), permits, employee recognition, travel including meals and lodging, all training (except as provided in direct-care and scholarship costs categories), voice and data communication or transmission, all office supplies regardless of what department is using them, property/liability insurance and other forms of insurance (see Classification of Insurance Costs under line 8049 in this instruction manual), personnel recruitment, accounting services, management or business consultants, data processing, information technology, web-site, business meetings and seminars, postage, fees for professional organizations, subscriptions, security services, allowable advertising (e.g. yellow pages), board of directors fees, working capital interest expense, and bad debt collection fees (but not the actual bad debt).Bad debt expense should be reported on line 8052.

Refer to Exhibit 1: Cost Classification Table of Potential Allowable Costs which provides a list of common expenses which should be categorized in general & administrative expense.

Items not recognized by Medicare such as the cost of telephones in resident rooms, contributions made, amounts donated to others, cost of political lobbying, personal expenses of owners or employees, costs related to fund raising events, expenses related to changes of ownership of the facility, expenses related to providing special services, promotional materials/advertising and penalties paid to governmental agencies (including Civil Monetary Penalties) should be separately reported on this line. The amount reported on this line should be removed from allowable nursing home costs by entering a negative amount in the adjustments column.

Refer to Exhibit 2: Cost Classification Table of Potential Non-Allowable Costs which provides a list of common expenses which should be categorized here.

Payroll Taxes and Fringe Benefits

9011 - 9026

This section of the Cost Report must be completed with the exception of line 9017.

·

Changes in Accrued Vacation/Sick Leave Pay may be reported in each individual cost category on the

lines ending with "17" for all employees in the nursing facility.

· The information on lines 9100 to 9280 may be completed in addition to this section to directly allocate the costs by cost category.

· Central office fringe benefits cannot be included on this page.

· Adjustments to offset payroll taxes and fringe benefits allocated to non-reimbursable areas or other operations should be made to the appropriate payroll tax or benefit line.

9023

“Other Employee Insurance” includes disability insurance and group life insurance.

9025

Report the employer portion of the dental insurance expense for the reporting period.

"Other Employee Benefits" includes day care, employee physicals, flu shots, and in-kind benefits. Expenses reported here must not be reported on lines 9210 to 9280.

These lines are optional and should be completed only if you choose to directly identify payroll taxes and fringe benefits to each cost category. However, if the fringe benefits and payroll taxes reported on lines 9011 through 9026 cannot all be directly identified -- leave lines 9110-9200 blank -- and the costs will be allocated based on a ratio of salary costs.

External Fixed

7012

Only amounts paid for real estate taxes should be reported on this line. Use the adjustment column to reduce the tax for all non-nursing facility square footage. Special assessments paid during the reporting year should be reported on line 7014.

Nonprofit organizations making payments in lieu of real

estate taxes must document the amount claimed on line 7012. This documentation

must be available if requested by the Department. The amounts for fire, police,

sanitation, and road maintenance services may be claimed.

CALCULATION OF MAXIMUM PAYMENT IN LIEU OF REAL ESTATE TAXES

Minnesota Statutes, section 256R.25 (i) provides,

"… Allowable costs under this paragraph for payments made by a nonprofit nursing facility that are in lieu of real estate taxes shall not exceed the amount which the nursing facility would have paid to a city or township and county for fire, police, sanitation services, and road maintenance costs had real estate taxes been levied on that property for those purposes.”

Facilities claiming amounts for payments in lieu of real estate taxes should be prepared to provide the following upon request by the Department:

· Tax capacity of the facility (show how the amount is computed);

· Tax capacity rates for fire protection, police, sanitation, and road maintenance;

· Any other information needed to compute the amount paid in lieu of real estate taxes; and

· A signed statement from the County Assessor, City or Township Clerk, and County Auditor verifying the amounts used for the tax capacity and the tax capacity rates for the four services are correct.

SAMPLE CALCULATION OF PAYMENT IN LIEU OF TAXES

|

TAX CAPACITY |

25,795 |

|

|

Market Value of Facility |

737,000 |

|

|

Times Tax Capacity % |

x 3.5% |

|

|

Tax Capacity |

25,795 |

|

|

TAX CAPACITY RATES |

||

|

Fire Protection |

2.6407 |

|

|

Police |

4.8768 |

|

|

Sanitation |

15.9093 |

|

|

Road Maintenance |

19.4668 |

|

|

Total Capacity Rate |

42.8936 |

|

|

MAXIMUM PAYMENT IN LIEU OF REAL ESTATE TAXES |

11,064 |

NOTE: This is the maximum that would be allowable. If this is not the actual amount being paid to the county, you will also include the actual amount that will be paid with the information submitted upon request.

7014

Special assessments paid during the reporting year should be reported on this line. Use the adjustment column to reduce the special assessments for all non-nursing home square footage. Special assessments must not be included with real estate taxes on line 7012.

7015

Only the Minnesota Department of Health nursing facility license fee costs are to be reported on this line.

7017

ONLY the allowable expenses related to the scholarship

program should be reported on this line.

These expenses are limited to amounts related to tuition, mandatory fees, required books and supplies, allowable day care costs and transportation expenses related to direct educational expenses, nursing assistant training, testing and associated expenses, reimbursement for qualified student loan expenses and Adult Basic Education (ABE) Training costs.Contact the Department staff Scholarship Program contact for instructions on how to report in-house training for nursing assistants.

The amount entered in the “balance per books” column must tie to the total facility scholarship expenses calculated and system generated in section seven of this cost report. Only whole dollars are accepted in this field. The total (system calculated) facility scholarship amount in section seven should be rounded to the next whole dollar and entered here. For additional instructions to report scholarship costs, refer to the section titled “NF Employee Scholarship Program” at the end of this instruction manual.

7018

Report the cost of PERA contributions on this line.

7020

Report the cost of Resident & Family Advisory Council Fees on this line.

9021

Report the employer contributions to Health Savings Account and Health Reimbursement Arrangements.

Report the employer portion of the group medical insurance expense for the reporting period.

Per MN Statutes, Section 256R.02, Subd. 18: "Employer health insurance costs" means premium expenses for group coverage, actual expenses incurred for self-insured plans, including reinsurance, and employer contributions to employee health reimbursement and health savings accounts. Premium and expense costs and contributions are allowable for (1) all employees and (2) the spouse and dependents of employees who are employed on average at least 30 hours per week.

Do NOT include dental insurance expense on this line; employee dental insurance expense is to be reported on line 9025

Record depreciation expense on these lines. Depreciation expense associated with non-nursing home assets should be removed in the adjustments column (e.g., attached hospitals, outpatient therapy areas, etc. Refer to "The Estimated Useful Lives of Depreciable Hospital Assets," issued by the American Hospital Association for guidance.

7031

Facility capital debt and lease interest expense includes all interest and finance charges. It does not include working capital interest expense.

7051 - 7059

Record the nursing facility's short-term (less than one year in length) lease or rental agreement information. Long-term leases and rentals are reported on line 7070. NOTE: Long-term leases that are 12 months in length or greater, but less than $2,000, are to be reported on line 7053.

Rental of off-site space for record storage or other purposes should be recorded on this line.

Report long-term lease expense on this line. Long-term is defined as 12 months or greater and at least $2,000.

Total Operating Expense

9300

The total balance per books should reconcile to total operating expense per your general ledger. Total operating expenses should equal the total reported for care related, support services, general and administrative, payroll taxes and benefits, external fixed, depreciation, interest and lease and rental expense.

Revenue

Report all revenue for resident related care on these lines according to payor source. Revenue reported as an applicable credit in the operating expense sections of the cost report should be removed in the adjustments column in the revenue section of the report. Revenue adjustments would also include (be equal to) amounts recorded in the operating expense sections as an offset (applicable credit) to therapy, pharmacy or other ancillary services. For example, $500,000 in contract therapy expense was adjusted from allowable expense because therapy is separately reimbursed. You must enter an adjustment of $500,000 in the revenue section of the report to reduce the revenue account for that amount.

Medicare or other third party revenue should include the contractual adjustments in the balance per books column rather than the adjustments column.

Description of Revenue |

Where to record on Cost Report |

|

Private room differential for a Medicaid resident; MA is the payor. |

MA, line 9410 |

|

Medicaid gross adjustments |

MA, line 9410 |

|

Payment for Medicaid resident by MA for bed hold day(s) |

MA, line 9410 |

|

Private room differential for a Medicaid resident; Resident/Guarantor is the payor. |

PP, line 9420 |

|

Spend-down for Medicaid resident; Resident is the payor. |

MA, line 9410 |

|

Medicare co-insurance; Resident/Guarantor is the payor. |

MC, line 9430 |

|

Payment for Medicaid resident by Guarantor or family member for bed hold. |

PP, line 9420 |

|

Contractual adjustments for Medicare. |

MC, line 9430 |

|

Medicare co-insurance bad debt for dual eligibles. |

MC, line 9430 |

|

Hospice |

Other, line 9440 |

|

Medicare cost report settlements for prior year(s). |

Put to prior year; not on Cost Report. |

Record other revenue such as vending income, restricted interest income, revenue not directly related to the operation of the nursing facility, and contributions, etc. on this line. The adjustments column should be used to remove revenue not directly related to the operation of the nursing facility. For expenses offset in the operating expense section of the report there should be a corresponding revenue adjustment.

Gain or loss on disposition of assets. The gain or loss will be based on the selling price and either: 1) the original cost or 2) the book value and accumulated depreciation. The sum of book value and accumulated depreciation is the original cost of an asset.

Balance Per Books "Total Revenue" (line 9400) less Balance per Books "Total Operating Expense (line 9300) should equal your "Net Income" on your financial statements.

Section 6: Assets/Debts/Leases

Square Footage

9510

Record the total square footage of the therapy area.

9520

"Other Non-nursing Home Area" includes, but is not limited to, assisted living, day care, coffee shops, etc. In computing the square footage of a non-nursing facility usage area, use inside wall to inside wall area.

9525

Hospital Space refers to the gross square footage of the attached hospital (the footprint).

9530

"Unused Space" includes, but is not limited to, units or wings of the nursing home no longer used for resident care or storage of equipment/records.

9540

Report the gross square footage of the nursing facility less any square footage already accounted for above. Gross square feet includes both direct assigned (e.g., resident, laundry, housekeeping) and undefined (common) areas such as hallways, stairwells, lobby, chapel, and solarium.

Current Assets

1360 - 1369

Capital Assets: For each type of capital asset listed, record the nursing facility's fiscal year-end balances and any additions or disposals to those capital assets since the provider's fiscal year-end to arrive at balances as of the report year-end, September 30, 2017.

· Disposals should be recorded as a negative number.

· Do not record corporate, affiliated, or central office capital assets since they are not used by the nursing facility in the provision of nursing care services.

To determine whether or not to report an asset in this section depends on whether or not the additions were required to be capitalized according to GAAP. Hospital-attached facilities that cannot directly identify changes in the nursing facility’s capital assets are to use the Medicare step-down method to allocate the costs.

Accumulated Depreciation is the sum of all depreciation expense claimed for all of the facility’s active assets. If an asset is fully depreciated, the cost of the asset is the amount to report in Accumulated Depreciation as long as that asset is still being used for resident care. Assets that have been disposed are not to have any value included in Accumulated Depreciation. The facility may have more than one Accumulated Depreciation value (e.g., one for Medicare, one for taxes, one for books). Report the book balance on the cost report. In some instances Medicare allows assets to be depreciated above their cost. If you do not have a book balance and will be reporting the Medicare value, do not include amounts that represent depreciation above an asset’s cost.

1371

Funded depreciation is actual money (cash account) set aside for the replacement of capitalized assets.

Debt

General

· All current debts with capital assets pledged as collateral are to be reported.

· Detail of working capital debt is not required.

· Working capital debt interest expense is to be recorded on line 8050, Net Working Capital Interest Expense.

o Working capital debt is defined as a loan that is not secured by capital assets, but is secured by commitments to current assets, such as receivables, or has no security other than the provider's good name.

· The provider is to report all debt currently held.

· Debts recognized for rate setting purposes in the past but not currently held should not be reported.

· Hospital-attached facilities that do not directly identify the debt associated with the nursing facility’s capital assets are to use the Medicare step-down method to allocate the amounts. Report only the nursing facility share of debt associated with a hospital-attached facility.

Construction in Progress (CIP)

The identifying code for the loan type created to handle construction project draws over time is "19," referred to as "Construction in Progress (CIP)." The sum of the draws for the reporting year should be reported as negative principal payments for CIP loans. The reporting year that the project is completed a new loan should be reported on the cost report with a new loan code number/type assigned.

Debt Information

Loans reported on the prior year's cost report are displayed here. For each existing loan click on the "Select" button and update the reported information as needed. If a loan is listed and no longer exists, select the "Delete" button to remove the loan. New debt can be added by selecting the "Create Loan" button.

For all debts, the following are general explanations of the data fields.

· Date of Loan: Enter the date the loan agreement was signed.

· Type of Loan: Enter the code below which most closely corresponds to the type of loan listed.

· Type of Capital Asset Associated with the Loan.Select from the following codes/descriptor:

o 10. Land

o 11. Building and Building Improvements

o 12. Attached Fixtures

o 13. Land Improvements

o 14. Depreciable Equipment (other than vehicle)

o 15. Vehicles

o 16. All the above items

o 17. Codes 11, 12, and 13

o 18. Codes 11, 12, 13, and 14

o 19. Construction in Progress (CIP)